How Unclaimed Money Works

If you’ve ever moved, changed jobs, closed a bank account, or had a loved one pass away, there’s a chance unclaimed money could exist in your name. Understanding how unclaimed money works is the first step toward finding and claiming funds that may legally belong to you.

What Is Unclaimed Money?

The state does not take ownership of unclaimed money. Instead, it acts as a custodian, holding the funds indefinitely until the rightful owner or heir files a valid claim. There is no expiration date on most unclaimed money, meaning you can claim it even decades later.

Common forms of unclaimed money include forgotten bank accounts, uncashed checks, insurance payouts, and utility deposits. Because these assets often result from everyday life events, many people don’t realize unclaimed money exists in their name.

Where Does Unclaimed Money Come From?

Unclaimed money comes from everyday financial activity that becomes disconnected from its owner over time. When companies are unable to contact the rightful owner after repeated attempts, the funds are considered abandoned and must be reported to the state.

Most unclaimed money originates from businesses — not the government. These businesses are legally required to turn the funds over to the state after a dormancy period, which typically ranges from one to five years depending on the asset type and state law.

Some of the most common sources of unclaimed money include:

- Bank accounts that were forgotten, closed improperly, or left inactive

- Uncashed checks, such as payroll checks, refunds, or rebates

- Insurance payouts from life, health, or property policies

- Utility and security deposits from previous residences

- Stocks, dividends, and brokerage accounts that lost contact with the owner

- Safe deposit box contents that went unpaid or abandoned

Because these situations often occur after life changes like moving, changing jobs, getting married, or experiencing the death of a family member, many people never realize these funds exist.

Why States Hold Unclaimed Money

When money or financial assets go unclaimed, state governments step in to protect the rightful owner. This process exists to ensure that abandoned funds are not permanently lost, misused, or absorbed by private companies.

After a dormancy period passes and attempts to contact the owner fail, businesses are legally required to transfer the unclaimed funds to the state. This process is commonly referred to as escheatment. While the term may sound complicated, the idea behind it is simple: the state holds the money in trust until the owner or their heirs come forward.

States do not profit from holding unclaimed money, and they do not take ownership of it. In most cases, unclaimed money can be claimed at any time — even decades later — as long as proper documentation is provided. This legal safeguard is why searching official state databases is the safest and most reliable way to look for unclaimed funds.

Each state operates its own unclaimed property program, following laws designed to protect consumers and ensure transparency throughout the process.

How the Unclaimed Money Process Works (Step-by-Step)

The unclaimed money process follows a consistent legal framework across all U.S. states. While each state operates its own database, the overall process for identifying, reporting, and claiming unclaimed funds is largely the same nationwide.

Below is a simple step-by-step overview of how unclaimed money moves from a business to the state and, ultimately, back to its rightful owner.

Step 1: Money Becomes Inactive

When an account, check, or financial asset has no activity for a specific period of time, it is classified as inactive. This dormancy period varies by asset type and state law, but it typically ranges from one to five years.

Examples include forgotten bank accounts, uncashed payroll checks, or unused insurance benefits.

Step 2: Businesses Attempt to Contact the Owner

Before turning funds over to the state, businesses are required to make reasonable efforts to contact the owner. This usually includes mailed notices, emails, or other outreach attempts using the last known contact information.

If the owner cannot be reached, the asset is considered abandoned under state law.

Step 3: Funds Are Transferred to the State

Once the dormancy period ends, the business transfers the unclaimed funds to the state’s unclaimed property program. The state records the owner’s name, last known address, and details about the asset.

At this point, the state becomes the custodian of the money, holding it safely until a valid claim is made.

Step 4: The State Publishes the Unclaimed Funds

States make unclaimed money searchable through public databases. These databases allow individuals and businesses to search by name, business name, or address to see if funds exist in their name.

This is the stage where most people first discover unclaimed money.

Step 5: The Owner Files a Claim

If a match is found, the rightful owner (or legal heir) can submit a claim through the state’s official process. This typically involves verifying identity and proving ownership or relationship to the original owner.

Claims are reviewed by the state before approval.

Step 6: Funds Are Returned to the Owner

Once approved, the state releases the funds to the claimant, usually by check or direct deposit. Processing times vary by state and claim complexity, but most claims are completed within several weeks.

Is Unclaimed Money Legit and Safe to Claim?

Yes — unclaimed money is completely legitimate and safe to claim when you use official sources. Every U.S. state operates a government-run unclaimed property program designed to protect consumers and reunite them with money that legally belongs to them.

Unclaimed money programs are regulated by state law and overseen by state treasury or revenue departments. These programs exist specifically to prevent abandoned funds from being absorbed by private companies or lost permanently. When you file a claim through an official state database, the state verifies your identity and ownership before releasing any funds.

It’s important to note that states never charge a fee to search for or claim unclaimed money. If someone asks you to pay upfront to access state databases or guarantee results, that is a red flag. Legitimate claims only require proof of identity and, in some cases, documentation connecting you to the listed address or account.

By relying on official state resources and trusted educational guides, you can safely search for and claim unclaimed money without risk.

Be cautious of emails, phone calls, or social media messages claiming you must “act immediately” or pay a fee to receive unclaimed money. State unclaimed property offices do not cold-call, demand payment, or pressure you to claim funds quickly.

What You Need to Claim Unclaimed Money

Claiming unclaimed money is generally straightforward, but states require specific information to confirm that funds are released to the rightful owner. The exact requirements vary by state and by the type of asset being claimed, but most claims follow a similar documentation process.

Before starting a claim, it helps to gather basic personal and financial information so the process goes smoothly and without delays.

In most cases, you will need:

- Proof of identity, such as a government-issued photo ID

- Your Social Security number or Tax ID (for identity verification)

- Proof of address, especially if the unclaimed funds are linked to a previous residence

- Documentation connecting you to the asset, such as account statements, employment records, or insurance paperwork

If you are filing a claim on behalf of a deceased family member, additional documentation may be required. This can include a death certificate, proof of relationship, or legal authorization such as executor or heir documentation.

While this may sound formal, most states provide clear instructions and allow documents to be uploaded securely online. Preparing these items in advance can significantly speed up the claim review process.

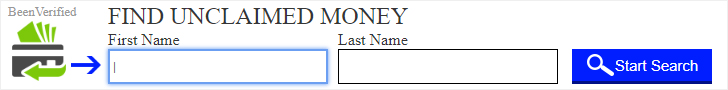

Next Steps: How to Search for Unclaimed Money in Your Name

Now that you understand how unclaimed money works, the next step is to search official databases to see if funds exist in your name. Because each U.S. state maintains its own unclaimed property program, searches are typically done state by state using government-run databases.

Start by searching the state where you currently live, followed by states where you have previously lived, worked, or owned property. If you’ve moved, changed jobs, or had family members pass away, it’s especially important to search multiple states using variations of your name.

Searching is free, secure, and can be done online in just a few minutes. If a match is found, the state will guide you through the claim process and let you know exactly what documentation is required to move forward.

Frequently Asked Questions About Unclaimed Money

How do I know if I have unclaimed money?

The only way to know for sure is to search official state unclaimed property databases. Because each state maintains its own records, you should search every state where you have lived, worked, owned property, or done business.

Many people discover unclaimed money after moving, changing jobs, or when searching records for a deceased family member.

Is unclaimed money really free to claim?

Yes. States do not charge any fees to search for or claim unclaimed money. The process is funded and managed by state governments as a consumer protection service.

If a website or individual asks you to pay just to look up your name, that is not an official state program.

How long does it take to receive unclaimed money?

Processing times vary by state and by the complexity of the claim. Simple claims may be approved in a few weeks, while others can take longer if additional documentation is required.

Once approved, funds are typically sent by check or direct deposit.

Can I claim unclaimed money for a deceased relative?

Yes. Heirs, beneficiaries, and estate representatives can claim unclaimed money on behalf of a deceased individual. States usually require proof of death and documentation showing your legal right to claim the funds.

This often includes a death certificate and proof of relationship or executor authority.

Does unclaimed money ever expire?

However, claim rules and documentation requirements vary by state, so it’s best to begin the process as soon as you discover a potential match.

Why do I keep finding my name listed in different states?

Unclaimed money is tied to past addresses, employers, or businesses — not just where you currently live. If you’ve moved, worked remotely, or had financial accounts in other states, your name may appear in multiple databases.

This is normal and one reason why searching multiple states is recommended.