Find Unclaimed Money by State

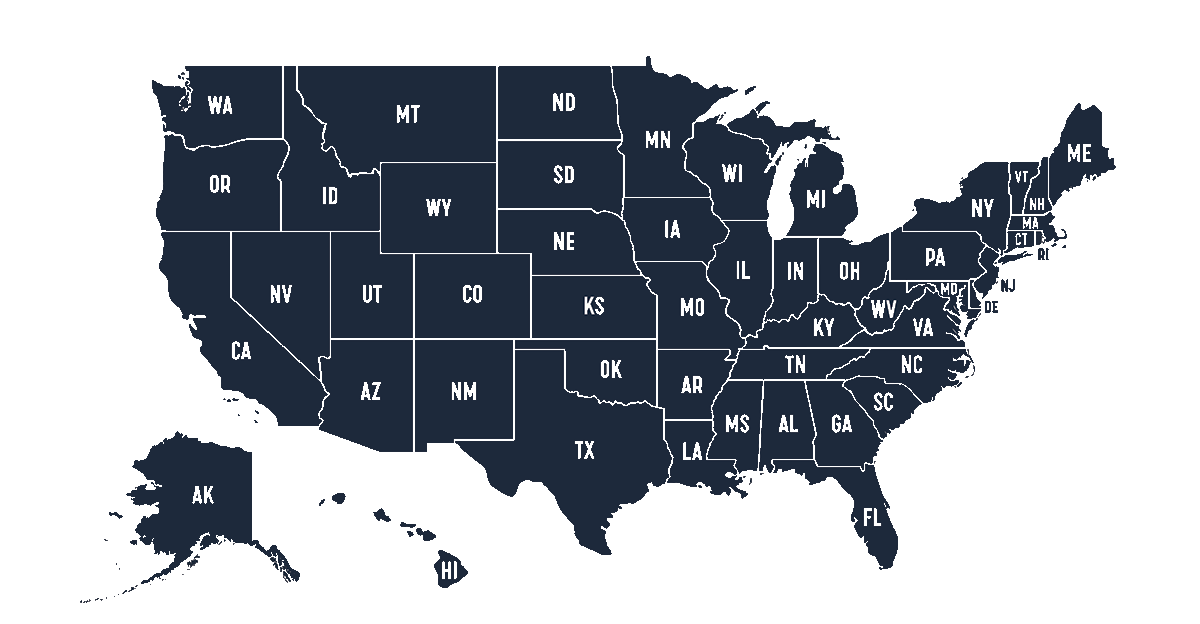

Each U.S. state maintains its own unclaimed property database, which may include forgotten bank accounts, uncashed checks, insurance proceeds, utility deposits, refunds, and other financial assets. Because people move, change jobs, or open accounts in different states over time, it’s common for unclaimed money to exist in more than one state.

Using the list below, you can search official unclaimed property programs for every U.S. state and territory. Selecting a state will take you to a detailed guide explaining how that state’s unclaimed property system works, what types of assets may be available, and what information is typically required to begin a claim.

California Unclaimed Property

California holds over $11 billion in unclaimed property from forgotten bank accounts, uncashed checks, insurance benefits, and safe-deposit box contents. The California State Controller updates its database frequently, making it one of the most searched unclaimed property systems in the country.

Visit our complete guide to learn how to search the official database and file a claim:

New York Unclaimed Property

New York has one of the largest unclaimed property totals in the nation, with billions in lost funds from payroll checks, closed financial accounts, stock dividends, and more. Thousands of new accounts are added every day, which makes New York an essential search for anyone who has lived or worked in the state.

Visit our step-by-step guide to search the official New York database:

Texas Unclaimed Property

Texas maintains one of the largest unclaimed property programs in the United States, with billions in unclaimed cash and assets returned to residents each year. Texans can search by name, business, or address to uncover missing funds such as utility refunds, payroll checks, and dormant accounts.

Start your official search and learn how to claim your money here:

Florida Unclaimed Property

Florida’s Department of Financial Services holds hundreds of millions in unclaimed property, including dormant bank accounts, securities, and insurance proceeds. With a fast online search tool and a high rate of returned claims, Florida is one of the most-searched states for missing money.

Explore search instructions and claim steps in our guide:

Search Unclaimed Property by State

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming

Want a Deeper Search Across Multiple States?

State unclaimed property sites are the best place to start — but they may not show every type of asset or record. If you’ve lived in multiple states or want to explore other potential matches, you can run a broader public records search with our trusted partner below.

*Paid partner. We may earn a commission if you purchase through this link.

Unclaimed Money by State: Frequently Asked Questions

Can I have unclaimed money in more than one state?

Yes. It’s very common to have unclaimed money in multiple states. Unclaimed property is reported to the state associated with your last known address at the time an account was created or abandoned. If you’ve lived, worked, or done business in different states, you may need to search more than one state database.

Why does each state have its own unclaimed property database?

Unclaimed property is regulated at the state level, not federally. Each state operates its own unclaimed property program and database, with its own rules, claim process, and required documentation. This is why searches must be conducted state by state using official state programs.

Is it free to search and claim unclaimed money from a state?

Yes. Searching for and claiming unclaimed money through official state unclaimed property programs is completely free. States do not charge a fee to file a claim, though you may be asked to provide identification or proof of address to verify ownership.

What types of unclaimed property are held by states?

State unclaimed property programs may hold a wide range of assets, including dormant bank accounts, uncashed checks, insurance proceeds, utility deposits, refunds, and securities. The types of property and reporting rules can vary slightly by state.

How long does it take to receive unclaimed money from a state?

Claim processing times vary by state and by claim complexity. Some claims are processed within a few weeks, while others may take several months if additional documentation is required. Each state’s unclaimed property office provides estimated timelines once a claim is submitted.

Do I need to search every state individually for unclaimed money?

Yes, each state must be searched separately using its official unclaimed property database. However, identity-based search tools can help identify past addresses and states where unclaimed property may exist, making it easier to know which state programs to search.